Why traders choose PRB Securities

30 years

Experience

Since 1995

20 years

SEBI Regulated

Since 2000

45 K

Equities

Fast execution

24x7

Customer support

Account manager

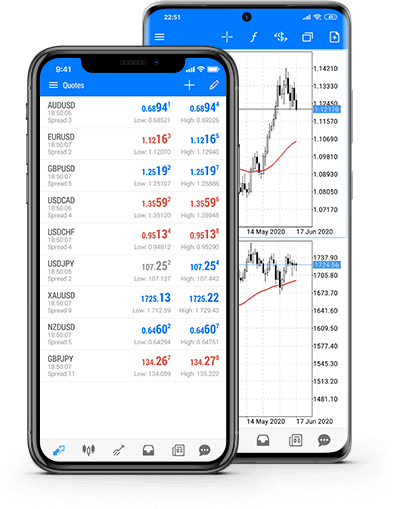

Mobile Trading:

Your trusted trading platfrom for any trade conditions

Download fromPlay Store Download fromApp Storedaily analysis

Analyse your trades on a daily basis

minimal deposit

Start trading with minimal deposit

High Speed

Execute trades in realtime basis

Explore Our products

Invest in cash products, trade with leveraged products or let the experts manage your money.

EQ

Equities

FnO

Derivatives

COM

Commodities

MF

Mutual Funds

FX

Forex

CFD

CFDs

IPO

IPO

FU

Futures

Hurry

Open an account with us and start trading now! Open Account

Award-winning support

Regulated by the SEBI,IN

30 years experience

Join over 1 million traders in India

Sign up for your demo account now.